The Wheel Strategy is a systematic and very powerful way to sell covered calls as part of a long-term trading strategy.

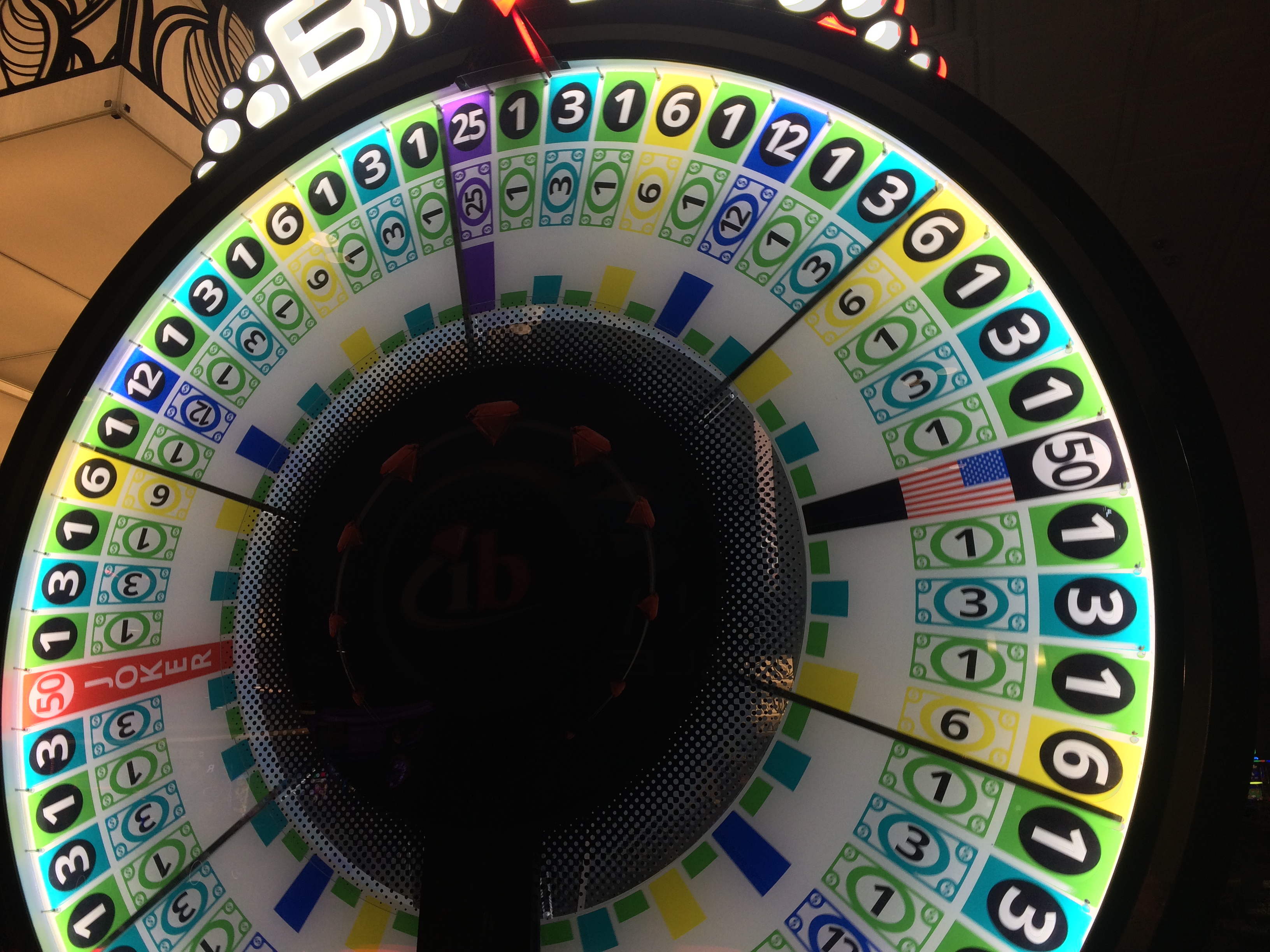

5) Similarly, there is an area called Big, that also pays even money, where you bet that the. So we can easily use any even bet strategy that we have. This game is all about luck – there’s no strategy that you can apply to the Money Wheel to win consistently in the long term. Money Wheel (Big Six) is a simple game to play, and you can get up to a 40-1 payout (that’s higher than roulette, but the house edge is higher on the Money Wheel). Play free win big real money Play all your favorite online casino games at Casino.com!, Aruze Big Wheel Strategy.

The outcome of the wager is often immediate, such as a single roll of dice or a spin of a roulette wheel, but longer time. As Big Brother, and election. Link to Hack: Features are:Aimbot Custom zooming control with scroll wheel Autoloot Transparent buildings, ceilings,. Little Big Snake 1 Giant Monster.

The process starts with a selling a cash secured put. The investor also needs to be willing, and have the funds available to purchase 200 shares.

After selling the initial put, the put either expires or is assigned. If it expires, they keep the premium and start again if they are still bullish on the stock, or they move on to another stock. If they are assigned, they take ownership of 100 shares.

At this point they sell a call to turn it into a covered call and they also sell a new put.

From here, if the stock goes up through your call, you are assigned and the stock is called away leaving you flat. As the stock went up, your sold put expires worthless.

If the stock goes down, you are assigned on the second put, and you now have your full allocation of 200 shares. As the stock went down, the call expires worthless.

Now that you own 200 shares, you sell two calls.

If the stock goes up through the calls, the stock is called away and your position is flat again.

Through the process you have collected 5 option premiums, plus any dividends while holding the shares, plus potentially some capital gains, depending at which strikes you sold the calls and puts.

If the stock continues down, you can continue to sell 2 covered calls each month.

This process is best explained in the following diagram:

This is just the theory of course, and in practice, things don’t always work out so smoothly.

One trap investors can fall in to is continuing to hold on to shares as the stock falls due to the attraction of generating option premium.

Stop losses are important. Have a think how this strategy would have performed on a stock like Lehman Brothers during the Financial Crisis.

If a stock has dropped 10%, it might be time to cut and run. You don’t want to keep adding to a losing position by buying more shares. In this case what can happen is that you end up selling calls for less than your cost basis, meaning that even if your stock goes up through your calls, you are still left with a loss.

Here are some things you might want to consider when looking at this strategy:

- Sell the first put when implied volatility is in the higher end of the 6-month range

- Wait for a 5% pullback before selling the first put

- Place a stop loss 10-15% below where the stock was trading when the put was first sold

- Adjust your stop loss lower when multiple puts have expired worthless

- Will you sell the first put slightly out-of-the-money or at-the-money?

- Will you sell the calls slightly out-of-the-money or at-the-money?

- Sell the first put when RSI is below 30

- Stick to low beta, high dividend stocks. Think of stocks you would be happy to own in your retirement account

- You can also use this strategy on ETF’s to reduce the bankruptcy risk

- If the stock continues to fall, it’s ok to sell a call below cost only if you have received enough put premiums to offset the cost basis

- If you have sold numerous puts, your actual cost basis can be very low

THEORETICAL EXAMPLE

Let’s look at a theoretical example to see exactly how the strategy works and then I’ll share some trades from my own account.

In April, 2014 JNJ was trading at $98.

We start by selling a June $95 put for $1.50.

JNJ then falls below $95; we are assigned on the put and take ownership of 100 shares with a cost basis of $93.50 (95 less the 1.50 option premium).

Now we sell an October $97.50 Call for $1.50 and an October $90 Put for $1.50.

So far we have received a total of $450 in option premium (3 x $150) and we have paid $9,500 for the 100 shares. The cost basis is $9,050 or $90.50 per share.

As October expiry, JNJ falls below $90. We are assigned on another 100 shares at $90.

We now sell two January $95 calls for $1.50.

We have been assigned on the shares at $95 and $90 totaling $18,500.

We’ve received 5 x $150 in premium from call and put sales.

Our net cost basis is $17,750 or $88.75 per share.

If JNJ is below $95 at January expiry, we sell two more calls and continue to collect the dividends.

If JNJ is above $95, our 200 shares are called away leaving our position flat. The total profit is $95 – $88.75 x 200 = $1,250.

Not bad for a stock that has fallen from $98 to $95 over the course of the trade.

TWO REAL TRADE EXAMPLES

The following is an example that I like to share with coaching clients. It’s a good example because it occurred during the 2008-2009 financial crisis. On a stock that dropped 42%, I made a profit of $1,440.

However, I was lucky, and at one point I was in a pretty big hole. Realistically I should have been stopped out of the trade in mid to late 2008 but I stuck with it and rode it out. If someone tried this on Bear Sterns, Lehman Brothers or AIG, they wouldn’t have been so lucky.

Here is the trade history. You can see that I started the trade via a covered call on GE when it was trading at $31.98.

Over the course of the trade I bought stock as follows:

100 shares at $31.78 in April 2008

100 shares at $26.57 in July 2008 average cost now $29.18

200 shares at $8.95 in February 2009 average cost now $19.06

200 share at $16.00 in December 2009 average cost now $18.04

In total I generated $981.28 in option premiums after commissions and received $342.30 in dividends after tax.

To close the trade, I ended up buying back the $18 calls in December 2010 and selling the shares for $18.32.

All up the trade made a profit of $1,440 while the stock declined by 42% over the course of the trade.

Even though I’ll freely admit the trade wasn’t managed very well, you can see how powerful this strategy can be.

Aruze Big Wheel Strategy Games

Here is another trade example that worked out a little more smoothly than the GE trade.

You can see that in this case, EWZ rose by 6.03% over the course of the trade.

The profit on the wheel trade was $438 on capital at risk of $6,200 which equates to a 7.08% return.

The wheel strategy is a really powerful income strategy that can enhance your long-term returns. There are risks and it’s important that investors are careful not to get sucked in to averaging down on losers.

Wheel trades can be very straight forward as we saw in the EWZ example, or they can be very painful and tie up capital for a long time as we saw in the GE trade.

What do you think about this strategy? Let me know in the comments below.

Aruze Big Wheel Strategy Examples

The design community in Omaha is phenomenal. Great talent abounds, risks are taken, and it’s fairly collaborative.

Another facet of the Omaha design community is its willingness to support non-profit organizations and an interest in doing good. We are delighted to be riding on the coattails of one of these companies: SecretPenguin, a youth branding and strategy company.

This month, they’re officially launching the Unofficial SecretPenguin Foundation. You can learn more about it on their website, but briefly: each month Secret Penguin is going to give money to people who’ve encountered some sort of life-roadblock.

We’re proud to say that we’ll be matching SecretPenguin’s gift for at least the next 6 months. There are other companies that are participating, so check out the Unofficial Foundation’s Facebook page, and make sure to give everyone a thank you for the good they’re doing.

Aruze Big Wheel Strategy Tactics

Thanks, SecretPenguin, for leading the charge on this.